uncategorized

“Apni Chhat Apna Ghar” Loan Scheme By Government of Punjab

Introduction

Chief Minister of Punjab is taking a very special initiative of “Apni Chhat Apna Ghar” Program. Aim of this scheme is to provide 100,000 affordable Houses / Apartments. For eligible people from all over the Punjab province, this will be a momentous development in Punjab’s housing sector.

“Apni Chhat Apna Ghar Program” will give facility to those who have low income and living in rented home, informal setting to have their own houses. This program will give 100,000 reasonable houses in all over the province within four and a half years with 03 Completing Models.

Punjab Housing & Town Planning Agency is executing Agency and Housing, Urban Development and Public Health Engineering Department (HUD&PHED) is administrative department for this Scheme.

Expected Outcomes of ACAG Program

- Better living for low-income families

- Reduced overpopulation and slum house.

- Improved access to basic facilities (water, sanitation, electricity).

- Increased security and community safety.

- To target beneficiaries, it will be positive impact.

- Strong social consistency and development of community.

- Construction of 100,000 houses would generate approximately half a million jobs.

- This will be contributed directly or indirectly to the economy of country.

How to apply

By visiting the official site portal or call at 0800-09100.

Model-1 (10,000 housing units)

In the accomplishment of Model-1 aims on state land to facilitate the construction of housing units through an equity-based land-sharing arrangement between developers and the PHATA.

Planning of program is development of infrastructure.

Also, the construction of housing units/apartments on state land based on a land equity arrangement.

For completion of infrastructure, including roads, services, and other comforts, Developer is responsible. Follow design and possibility provided by PHATA.

PHATA will provide a primary land use plan of selected site.

PHATA will also advertised sites for modest request.

Developers may request approval for a revised plan as per principles.

PHATA, will provide structural and relevant drawings of infrastructure and housing units/apartments through adviser firm.

The successful developer must ensure loyalty to design standards, material, and construction specifications at every step and site.

Responsibility for Developer is the full capital cost of infrastructure development and housing.

State land will get agreed percentage by PHATAP to the developer/contractor according to the agreed timelines at various stages of infrastructure development and housing construction.

The state land will not be provided any share or subsidy by the government for infrastructure development and housing construction.

Plan for instalment and price of each house unit/apartment will determine by government.

The layout plan for state land transferred to the developer/contractor will be approved by the Governing Body of PHATA.

Government body of PHATA also approved adhering to the land use plan and PHATA’s building regulations.

For each site using the slab allocation PHATA will develop the stalk infrastructure approved by the Government.

Model-2 (20,000 housing units)

This model emphases on the development of low-cost houses on 20% or above of residential area, Affordable Private Housing Scheme (APHS) Rules 2020 by the developers in each private housing scheme which is approved by PHATA.

These are following feature in this model:

This model highlights the allocation of 20% or above of residential area within private housing scheme (PHS), pointing to address the housing needs of low-income families.

Developers/contractor will be given approvals of their Private Housing Schemes under Affordable Private Housing Scheme (APHS) Rules, 2020.

The provincial Government will rationalize the approval process by providing one-window mechanism to ensure that the timelines for granting NOCs from each department are strictly followed to.

The developer will provide reasonable houses of size, design and price which determined by Agency (PHATA). Allottee will make down payment as fixed by Agency (PHATA) to the developer through an Escrow account, which will be jointly maintained by the developer/contractor and Agency (PHATA).

After receipt of down payment from allottee and subsidy of 1.00 million from government, possession will be given to the allottee.

Allottee will pay remaining amount on monthly instalments to the developer over a period of five years or as decided by Agency (PHATA).

Upon complete payments, allotment letter will be issued to the allottee by the contractor/developer.

Construction of houses will be administered by Agency (PHATA). Payment to the developer from Escrow account will be made on achievement of agreed milestones.

Model-3 (70,000 Interest Free Loans)

Under this model, interest free loans for house construction will be provided. A Revolving fund will be established to provide interest-free loans for the construction of houses to eligible individuals or families with following conditions:

Individual is a resident of Punjab and have residential plot of up to 5 marlas in urban areas and up to 10 marlas in rural areas. He/ She can apply for the interest-free loan through Apni Chat Apna Ghar ACAG’s website.

Maximum Loan amount will be Rs. 1,500,000.

The loan repay back in 7 years with easy monthly instalments.

Amount will be distribute in tranches to beneficiaries.

The revolving fund will continue to revolve until receiving back of interest free loans from the beneficiaries.

Sales tax and Operational costs will also be paid by the Government of Punjab.

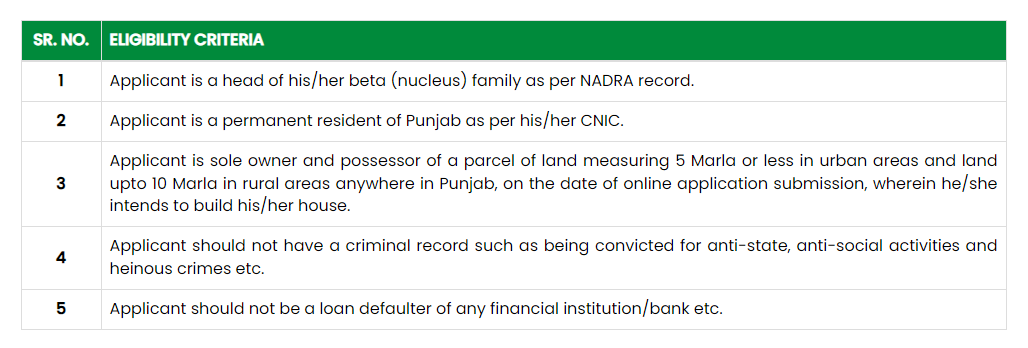

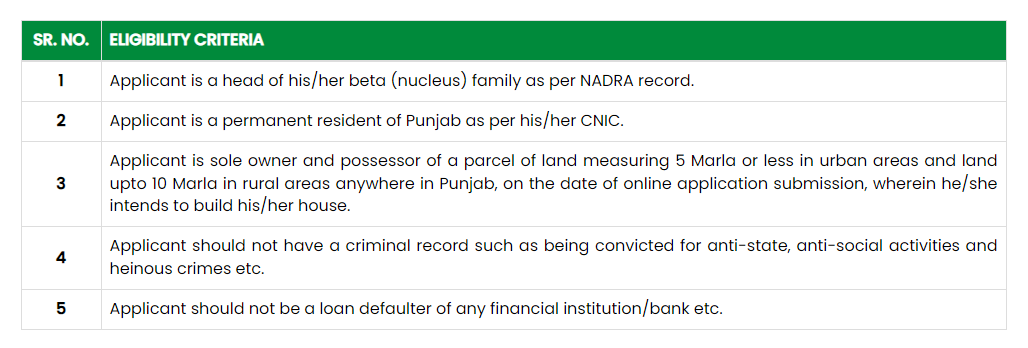

Eligibility Criteria to apply for Apni Chhat Apna Ghar Scheme

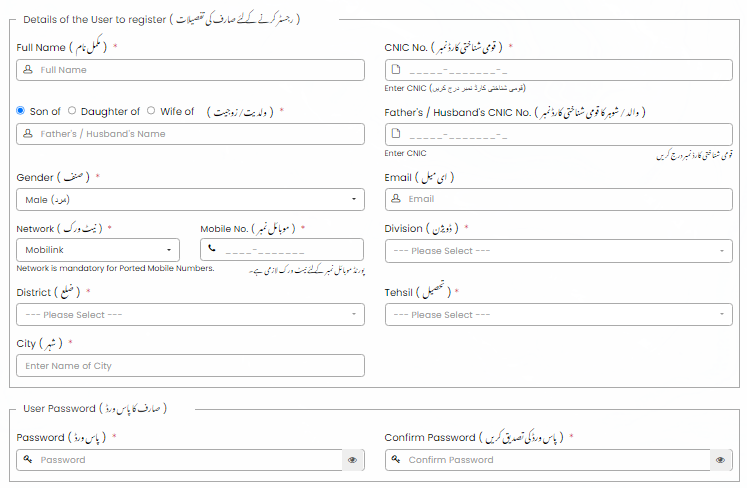

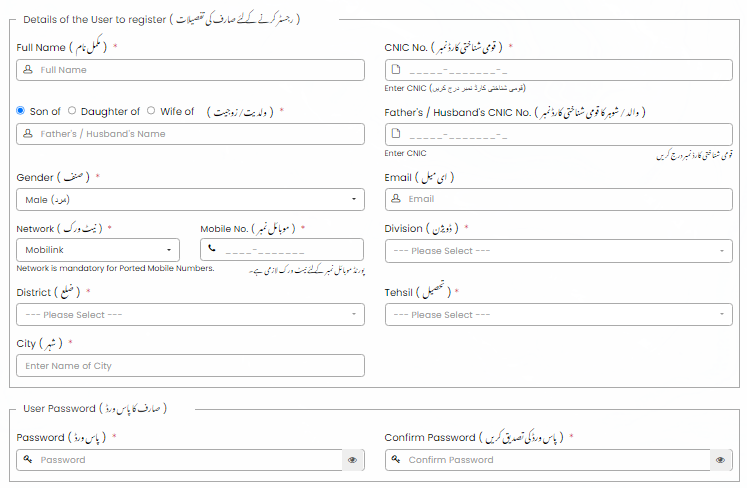

What the requirements for submitting application form?

Conclusion

This is great initiative taking by Government of Punjab to improve the lives of citizens. Interest Free Loan to the deserving eligible persons shows the commitment to the people of Punjab during high inflation challenging days.

If you have any query regarding Apni Chhat Apna Ghar Scheme, don’t hesitate to ask us from comment section or email us.

uncategorized

Master in Ethical Hacking with Android Free Course

Welcome to our Ethical Hacking course! In this course you will explore various tools and techniques used by ethical hacker. This will enhance your practical understanding and ensure you are trained to protect organizations against cyber-attacks.

Join us to embark on this exciting journey into the world of ethical hacking.

Here is the list of lectures, each video is important from start to end, don’t skip any part of this course. Keep learning……..

Introduction

Basic Tasks

Programming

Metasploit

Auxiliary Modules Metasploit

Nmap

Miscellaneous Hacking

uncategorized

Best Credit Card in Pakistan

What are Credit Cards?

The credit card allows you to avail money if you are short of it or need more money or cash when shopping. The credit card is also mean of payment without using cash. This money is borrowed from the bank or a financial institution that issued the card.

This card could be used to make purchases online or anywhere that accepts card payments. The amount borrowed has to be paid back usually within month. If failed to pay back in the time frame will, incur an interest. Interest is a percentage of the money you owe.

Some credit cards have attractive benefits like cashback, price discount, rewards depending on the respective card issuer policies. Credit cards are convenient and valuable, if it used wisely otherwise it could bit risky.

How Do Credit Cards Work?

Suppose you have money in your bank account. You use your debit or ATM card to withdraw money and can make payment. In other words, you are using your own money. What if you have not any money and want to make payment? This is where credit cards come into play. You use money of the card issuer money and then repay at the given time frame. If the amount is paid, no interest will be charged. However, short or late payments lead to interest payments. Frequently these are issued by banks or financial institution.

Benefits of Credit Card?

1. Make Valuable Purchases

Assume you wish to buy a mobile phone which is necessary nowadays. A credit card allows to make purchases without counteracting their budget.

They can buy the mobile phone or anything available on store or merchant and they also accept credit card, in interest-free installments. They can pay full amount over 03/06/09/12 months.

2. Rewards

Another benefit of credit card is that they offer several rewards such as discounts & cashbacks. Besides the two, credit card issuer offer other rewards such as access to premium facilities in airport and redeemable points. Some issuer companies also offer accidental coverage and travel insurance.

3. Improves Your Credit Score

While this is not a factor in Pakistan, western countries takes the credit score seriously. This is required when you apply of loan or finance, the bank will make decision based on your credit score. By paying timely bills, an individual can significantly improve his/her credit score.

4. Safer

Most of banks/financial institutions that issue credit card offers purchase protection. The issuer will reimburse the money for fraud or defective goods.

5. Interest-Free Cash Withdrawals

In Pakistan of course, not all shops accept debit/credit cards. This is due to some merchants/shops avoid these payment methods to avoid tax. However, most credit card issuer companies offer interest free cash withdrawals using credit card.

Types of Credit Cards

Balance Transfer Credit Card

A balance transfer credit card allows to transfer balance to another credit card with lower or zero interest rate. This can help you save money on paying more interest charges on your debt faster.

Cash Back Credit Card

A cash back credit card type of credit card that allow you to get cash back with a percentage on every purchase that you make using your credit card. The cashback can be redeemed as cashback in credit card or deposited into bank account.

Reward Credit Card

A reward credit card is a type of credit card that offers reward points (some banks named orbits), miles, or cash back for every purchase made using the credit card. These rewards can be redeemed in cash back form or other benefits the credit card issuer offers.

Discount Credit Card

A discount credit card is a type of credit card that offers discounts and cashback with partner retailers and businesses. The cardholder can save money at these partner retailers and businesses.

Travel Credit Card

A travel credit card is a type of credit card that offers rewards and other benefits by using credit card in traveling purpose like booking tickets. These rewards may include waived off foreign transaction fees, travel insurance, airport premium lounge access and other benefits to help traveler to save money. It can help you make your travel experience more relax and rewarding.

How to choose the Best Credit Card?

This is a challenging task to choose the best credit card in Pakistan as various options are available. However, there are some factors that you can consider to help you to choose the best credit card according to your needs.

Annual Fees

The annual fee is important when selecting a credit card. Some credit cards offer zero annual fee or waived fee for the first year, while others may have high annual charges/fees.

Interest Rates

The interest rate is the cost of borrowing money from the credit card issuer company. It is essential to choose a credit card with a low-interest rate.

Rewards Program

Many credit cards offer rewards programs that allow you to earn reward points or cashback on spending amount through credit card. Choose a credit card that offers high rewards on spending.

Cash Withdrawal and Balance Transfer Fees

It is essential to consider cash withdrawal and balance transfer fees as they increase your credit card balance.

Customer Service

A credit card with good customer service support can be helpful in case of any issues or queries. Choose a credit card that have a great responsive customer service support.

Credit Limit

Choose a credit card with a reasonable credit limit that is according to your spending needs.

Fraud Protection

Choose a credit card that issuer offer fraud protection to keep your card safe from fraudulent activities.

Online Access

Choose a credit card that offers online access, like make payments, and track transaction.

Sign-up Bonuses

Some credit cards issuer offer sign-up bonuses, such as reward points or cashback, when you issue credit card.

Partner Discounts

Some credit cards offer discounts with partner retailers and businesses. Look for a credit card that offers the additional perks if align with your need and lifestyle.

How to Apply for a Credit Card in Pakistan?

Applying for a credit card in Pakistan is now quite easy and hassle-free. There are following options:

Option 1

You can Visit the nearest branch of any bank that offer credit card to apply. They will ask for required information, including a Source of income, Bank statement, and other documents that help them to determine your eligibility.

Option 2

Call the bank’s helpline and apply for a credit card. As they have already your information, they can promptly decide whether to issue a card or not.

Option 3

Now most of the banks offer to their customers to apply credit card through mobile or internet banking app. Some of Banks official website provide a portal for applying credit card

Credit Card Eligibility in Pakistan

Different banks have separate eligibility criterion. Mainly they have following two cases to apply for a credit card.

In case of salaried individual, they have set a minimal salary requirement.

In case of self-employed people, a minimal account balance is a requirement.

You will need to visit the branch or call bank’s helpline to get detailed information about the eligibility criteria.

Here is Credit Card Name and their annual Charges in Pakistan

| Credit Card Name | Annual charges |

| Faysal Islami noor Card – Velocity / Classic Faysal Islami noor Card – Blaze / Gold Faysal Islami noor Card – Titanium Faysal Islami noor Card – Platinum Faysal Islami noor Card – World UBL Visa Gold PSO Auto Card UBL Visa Platinum Credit Card UBL Visa Gold Credit Card UBL Visa Silver Credit Card Bank Al-Habib Green Credit Card Bank Al-Habib Gold Credit Card Askari Gold MasterCard Askari Classic MasterCard Askari Platinum MasterCard Askari World MasterCard Alfalah VISA Platinum Credit Card MCB Platinum Credit Card MCB Gold Credit Card MCB Classic Credit Card HBL FuelSaver Green Credit Card HBL FuelSaver Gold Credit Card HBL Green Credit Card HBL Gold Credit Card HBL Platinum Credit Card Standard Chartered WorldMiles Credit Card Allied Visa Platinum Credit Card Allied Visa Gold Credit Card JS Platinum Credit Card JS Bank Gold Credit Card JS Bank Classic Credit Card Silk Bank Gold Visa Credit Card Silk Bank Platinum Visa Credit Card Standard Chartered MasterCard Easy Card Standard Chartered MasterCard Cashback Card Standard Chartered MasterCard Titanium Card Standard Chartered Visa Platinum Card Alfalah Ultra Cashback Credit Card Alfalah VISA Classic Credit Card Alfalah VISA Gold Credit Card Alfalah Titanium MasterCard | Rs. 4000/- Rs. 6750/- Rs. 7750/- Rs. 10000/- Rs. 16000/- Rs. 4000/- Rs. 6000/- Rs. 6500/- Rs. 2000/- Rs. 0/- Rs. 0/- Rs. 5000/- Rs. 3000/- Rs. 6500/- Rs. 8000/- Rs. 0/- Rs. 0/- Rs. 0/- Rs. 0/- Rs. 3000/- Rs. 6000/- Rs. 3000/- Rs. 6000/- Rs. 10000/- Rs. 8000/- Rs. 4000/- Rs. 2000/- Rs. 0/- Rs. 0/- Rs. 0/- Rs. 4000/- Rs. 8000/- Rs. 3000/- Rs. 3000/- Rs. 6000/- Rs. 7000/- Rs. 4000/- Rs. 0/- Rs. 0/- Rs. 0/- |